Burgundy - What happens next?

by Liv-ex

In October last year, two bottles of DRC Romanee Conti 1945 broke records, becoming the most expensive wines ever sold at auction. While the “unicorn” vintage and the acclaimed vineyard played a crucial role in the high prices achieved for these bottles, the acknowledgement of Burgundy’s broader investment potential has been widespread. Headlines have focused on DRC but the region’s success has not been limited to this iconic brand. Burgundy dominated the Power 100 – our annual list of the world’smost powerful fine wine brands. As the star of the show, 29 of its labels were featured, and it accountedfor 14 out of the top 20 price performers. Leroy was in the top spot, while Dujac – favoured by theAmerican DJ Khaled – was the biggest price riser.

Continuous highs

Burgundy has been on a relentless rise. The Burgundy 150 index, which tracks the price movements of the most active Burgundy wines in the secondary market (principally Grand Crus), has climbed astaggering 168.8% since 2010. At the same time, a growing worldwide interest in the region has movedits market share from 1% to 14.5% by value. The secondary market for Burgundy remains unshaken by events that have affected global financial markets and continues to broaden. In 2018, 1,585 uniquewines traded from 847 brands. The total value traded also continued to rise, while Burgundy’s exposure– the total value of bids and offers – a measure of its liquidity, surpassed £9.4million. So the question is –for how long can these trends be sustained?

The rising prices and En Primeur

The diversity the region offers, combined with its long winemaking tradition and the rarity of its wines are only some of the reasons for its formidable performance. A series of small harvests has been amajor factor in pushing Burgundy prices higher. Price rises were further strengthened as growingdemand met this reduced supply. This year’s En Primeur campaign might influence, if not change, the landscape: Burgundy, famous for its scarcity and exclusivity, has produced a high-quality and high- quantity vintage across both red and white wines. The current market release could generate a mixed response. It might benefit well-known brands that typically command high prices, as Burgundy has seen a trend of collectors following winemakers rather than vintages. At the same time, the impact onless famous labels and village level wines might be less positive as the enlarged production could siton the market for longer. Still, as high supply goes, Burgundy’s volumes seem modest in comparison toBordeaux and other regions.

What happens next?

In 2018, the Burgundy 150 Index hit an all-time high as price rises gathered pace. But there are signs that this record-breaking rise could be facing some headwinds. With fewer buyers at these stratospheric prices, Burgundy prices are beginning to show increased volatility – often a sign of a turn. This month’s Burgundy campaign for the 2017 vintage, which is set to be the largest since 2009, will be a test of the region’s new price levels.

The Burgundy 150 has shown a compound annual growth rate of 12.7% since its inception in December2003. In the past decade and a half, the index has experienced none of the volatility that affected the Bordeaux market, which was shaken by global events such as the financial crisis in 2008, the Chinesegovernment’s monetary stimulus package in 2009 and the Chinese antigraft campaign from 2011. Overthe past year, the index, denominated in Sterling, has risen in all currencies, vastly outperforming thebroadest measure of the market – the Liv-ex 1000.

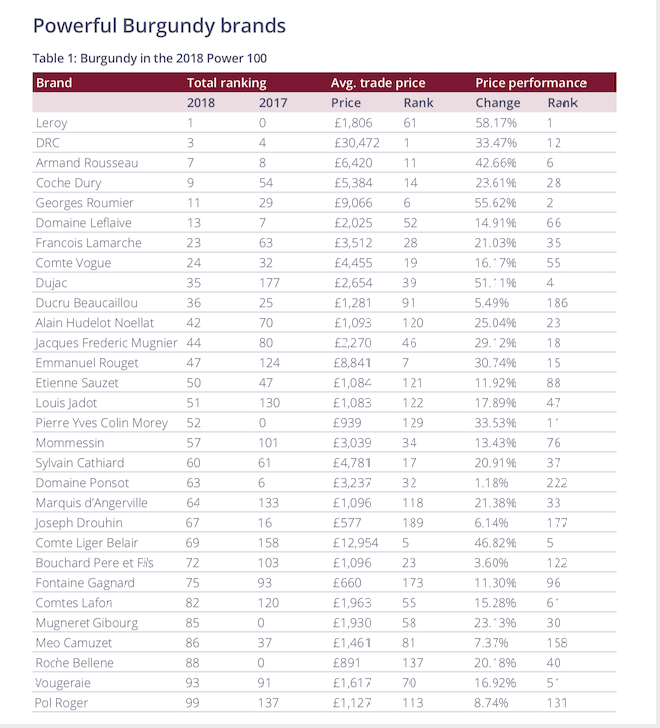

Powerful Burgundy brandsTable 1: Burgundy in the 2018 Power 100

Leroy took the top spot in the Power 100 – our annual list of the most important brands in the fine wine market – for the first time. It featured in the top ten rankings for four out of the five main qualifying categories, including price performance (which it topped), total trade value (nearly £1m), and number of wines traded. The elevation of Leroy is a prime example of the forces shaping Burgundy, where smallquantities stretched ever more thinly have boosted prices.

Scarcity is not the only prerequisite for rising prices; cult followings can also move the fine wine market. While this has long been the case for Champagne, be it Krug or Cristal, Burgundy saw asimilar phenomenon recently in Dujac. The label was the biggest riser in this year’s Power 100 – up an impressive 142 places. The story behind its success could be partially attributed to DJ Khaled, whoposted on his Instagram in January that he was “excited” about this wine that Jay-Z had recommended.Two days later Vogue Magazine published an article about it, while in March, Dujac was name-dropped in DJ Khaled’s song, Top Off: ‘Dujac by the mag that’s how we do wine, $91,000 for a wine bill, keep it real with you.’ Since then, demand for the wine has sky-rocketed. Dujac Market Prices are up 51% onaverage, making it the fourth best price performer in the 2018 rankings. With other Burgundian brandstaking up market share and pushing Burgundy prices up, the next section of this report questionswhether Domaine de la Romanée Conti remains in authority.

DRC

Burgundy saw record levels of trade this year – its market share by value hit a record high of 14.5%. Historically, DRC has accounted for the majority of Burgundy trade, and the region’s share was pushed up or down by activity for the iconic brand, as chart 11 shows. DRC has previously accounted for as high as 96% of Burgundy trade (in 2002).

More recently, however, Burgundy’s trade share has risen without a significant boost from DRC. DRC’sshare of Burgundy has been drifting lower, currently at 30%, as the market has broadened. Indeed, its biggest decline in the past ten years was in 2017, when we saw a record number of brands trading on the secondary market. DRC might have stolen the headlines, but it has not been the driving force behindthe region’s market share. Leroy, Ponsot and Armand Rousseau have been some of the main Burgundydrivers.

Conclusion

Burgundy has lived up to the highest of expectations in the past year. It has risen significantly, both interms of market share and price performance. Wines from the region seem to be as desired as ever, butthere are reasons to be cautious. As this report suggests not all metrics point to endless blue sky.

There are three important things to note. First, market confidence in the region may start to wane ifprices continue to rise. Higher prices bring supply to the market as collectors seek to sell and cash in. While demand and scarcity continue to drive Burgundy prices, expect to see more volatility if they continue to spiral upwards.

Second, 2019 will be a test of Asian demand as growers seek to build direct relationships with theregion.

The Burgundy 150 Index has offered positive returns for the past decade. It has outperformed global equities, while its DRC sub-index has outpaced some of the most prominent luxury groups, which have suffered from a Chinese slowdown. Is this sustainable?

Third, could the 2017 vintage influence the market’s direction? Its decent sized crop and considerable quality, particularly among the whites, has given critics, merchants and collectors plenty to talk about. If prices have risen off the back of limited supply, a large vintage could depress this. Yet even at the bestof times, production levels in Burgundy are small compared to other regions, and this vintage may be exactly what is needed to feed the market.

With all of this, Burgundy remains in the spotlight. It continues to rise relentlessly, and we all continue toask the question: for how long?