The Fine Wine Market in 2021

All previous records set in 2020 have been broken and surpassed in 2021, marking the most successful year ever for the secondary fine wine market.

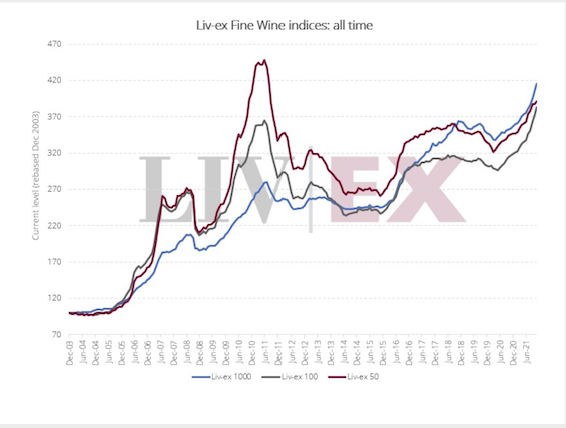

Fine wine trading continually broke new ground in terms of the value of wine traded and the sheer breadth of wines now active in the market. The ndustry benchmark, the Liv-ex Fine Wine 100 index (which tracks the price performance of the 100 most-traded wines in the secondary market), reclaimed and then exceeded its decade-old former peak, while the Liv-ex Fine Wine 1000 rose for 18 consecutive months.

Fine wine collectors returned in force to classic labels and regions, even as the market base continued to broaden and diversify.

On the surface, this year appears very simple. As our accompanying charts show, the entire direction of the market has simply been… up. But there’s much more to it than that.

The recent publication of the 2021 Liv-ex Power 100 explained many of the reasons behind this year’s results. After a challenging start to 2020, the impetus from the latter half of last year continued, unabated, throughout this year.

The legacy of accumulated savings from the 2020 lockdown and low-to-zero interest rates continued to drive investment in alternative assets. Even when lockdown measures largely eased, fine wine remained in the spotlight.

One important change was the end of US tariffs on European wine imports. Suspended in March and formally abolished in June, this brought US buyers back to replenish their supplies of Bordeaux and Burgundy, providing both regions with demand that was largely denied to them in 2020.

This helped redress the balance of the market after last year’s surging performance from Italy, California and the Rhône but did not stop the market from continuing to broaden and diversify.

On the one hand, brand new wines from non-mainstream countries and regions (Lebanon, Austria, Armenia) traded for the first time. On the other hand, trade deepened within established categories such as Burgundy, Italy and California.

Many may have hoped that 2021 would be the year when our societies broke free of Covid-related restrictions and discussions. As the year draws to a close, it is clear that we are not quite free of it yet.

Nonetheless, with a continued lack of clarity surrounding the future, enthusiasts, collectors, and investors have continued to trust in the steady returns and gustatory pleasures of fine wine.

It remains to be seen if this bullishness will survive the likely return of tighter fiscal and monetary conditions.

Over the last year, fine wine (as measured by the Liv-ex Fine Wine 100 index) has been a better investment than several traditional equity markets, including the FTSE 100, Dow Jones and gold.

The Liv-ex 100, 1000 and 50 indices, have risen every month this year. Both the Liv-ex 100 and Liv-ex 1000 have now enjoyed 18 consecutive months of positive progress.

What’s driving fine wine prices?

As the market broadens and prices rise across a greater variety of labels, it is no surprise that the broadest measure of the market, the Liv-ex 1000 index, has started to emerge as the top-performing of the three indices.

As the chart above shows, the Liv-ex Fine Wine 1000 index – which tracks the price performance of 1,000 wines from across the world – is up 315.3% since inception. By contrast the Liv-ex 100 and Liv-ex 50 are up 282.5% and 290.4% respectively.

This does not quite tell the whole story, however. It is in fact the Liv-ex 100 which has been quietly out-performing the Liv-ex 1000 and Liv-ex 50 over the last two years.

The benchmark index not only returned to the peak it achieved in 2010-11 at the height of the China-driven bull run, but it also surpassed it in October.

Even as equity markets were rocked in November after the news of the new ‘Omicron’ variant, the Liv-ex 100 rose 2.7%.

The performance of the Liv-ex 100 is a testament to the rising prices at the very top end of the market. With blue chip Bordeaux and most especially Burgundy back in vogue, the benchmark index is hitting its stride once again.

The Liv-ex Fine Wine 50, which tracks the performance of the First Growths, is rising more slowly than the Liv-ex 100 and Liv-ex 1000. The Liv-ex 50 rose the highest during the 2010-2011 bull market and is the only one of the three indices not to have returned to that former peak.

This is because the price-performance of individual vintages has not been as dynamic, despite the total value of First Growths traded this year being very high.

Therefore, although the First Growths are among the top traded wines by value this year, neither the Liv-ex 50 nor the broader Bordeaux 500 indices, have been reclaiming old records or out-performing their peers.

The biggest price risers in 2021

Looking at the top price-performers this year, it is clear why the Champagne 50 and Burgundy 150 have been the leading Liv-ex 1000 sub-indices.

As mentioned above, Salon 2002 has led a near-universal set of rises across the Champagne 50 and is up 80.1% year-to-date. The wine has been traded actively throughout the year. It has been sought after since its release in 2017, but, now approaching its 20th anniversary, it has found some extra impetus.

Prices of DRC continue to climb though the biggest rises have been for its ‘other’ grands crus such as Grands Echézeaux and Richebourg, some of which have risen over 50% in price.

Domaine Leroy, not included in the Liv-ex 1000 due to its lack of liquidity, has likewise continued to see big rises across its range.

The rising demand and prices for these leading labels is continuing to have a knock-on effect for Burgundy’s remaining grands crus. Indeed, Armand Rousseau’s 2012 Chambertin was the second-best price performer (+73.6%), followed by Georges Roumier’s 2013 Bonnes Mares (69.1%) and Leflaive’s 2013 Bâtard-Montrachet (66.6%).

Beyond the big names we continue to see solid performances from other grand cru appellations. The Corton-Charlemagne from Bonneau du Martray and wines of Clos de Tart have also had a very positive year.

There is also the significant problem of supply. Rising global demand has coincided with increasingly small vintages in Burgundy. The harder they become to obtain, the more expensive many of these wines become.